Contents:

Price spends most of the time in consolidation areas. In an impulsive wave, at least one wave needs to extend. But, the extension means the wave is bigger than 161.8% of the previous wave. It is no surprise that the most significant reactions occur from 50%, 61.8% and 78.6%.

This strategy looks for a crossing over of the MACD indicator, when a security’s price touches an important Fibonacci level. When this happens, a position can be opened in the direction of the trend. You’ll need to follow some basic forex trading rules. First, discover whether you are in an uptrend or downtrend. Then, figure out the highest and lowest swings in the chart formation. Finally, make the trend your friend by trading on it.

Now the lines are so close together, you can barely make them out. The Fibonacci analysis pointed in advance to this level being an area of support. How do we measure the Fibonacci percentages of an extension? You measure the size of the original move from the end of the retracement or the beginning of the extension. This gives you potential targets to where the extension could go on to.

For example, traders will perhaps use a few key moving averages, candlestick analysis, stochastics, etc, and then use Fibs as an overall tool to identify high probability market reversal areas. Fibonacci trading doesn’t just apply to rising markets. If a market has fallen, then Fibonacci fans will apply the retracements to bounce back up. Let’s take an example of a market that has dropped 100 points. If it rallies 38.2%, then those looking at Fibonacci retracements will expect the rally to run out of steam.

How To Trade Fibonacci Retracements And Extensions (With Examples)

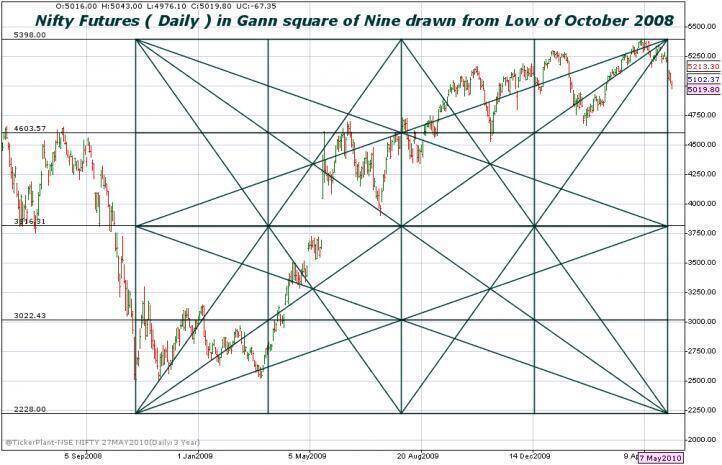

There’s no rule related to the 4th wave price retracement. The EURAUD chart below shows an example of how to use the Fibonacci time zones indicator. In an impulsive wave or a five-wave structure, the time zones indicator gives the estimated time the 4th wave will take. A simple look at it tells you the bias is bullish. Because of the higher lows series, traders have a bullish bias.

Almost all traders have a trading style or set of strategies they utilize in order to maximize profit potential and keep their emotions in check. The Fibonacci trading strategy utilizes hard data and if a trader adheres to their strategy, there should be minimal emotional interference. When entering a sell position near the top of the large move, you can use the Fibonacci retracement levels as profit-taking targets. How to filter off market noise with the Laguerre polynomials. Description of Laguerre RSI parameters and forex trading strategies with Laguerre RSI indicator. Wait for a reversal signal from the oscillator and patterns.

When a Fib target and a Fib retracement line up at the same price, then the likelihood of price reacting to it has substantially increased. We are going to recap the detailed examples shown above by going back over the general principles you should apply when using Fibonacci levels to trade Forex. Can you start at different points to measure your retracement? A retracement can be measured with different Fibonacci levels using different starting points for the Initial Move. The price moves from the major low, at Point 1, to the major high at Point 2, then retraces 61.8% of that distance, before moving off again to continue the original upward trend.

Because these https://traderoom.info/ are inflection points, traders expect some type of price action, either a break or a rejection. The 0.618 Fibonacci retracement that is often used by stock analysts approximates to the « golden ratio ». Moving averages can be used to validate anticipated change in the direction of price movement at the Fibonacci retracement levels. 50 and 100 moving averages are used as dynamic support and resistance in confluence with the Fibonacci retracement level to confirm high probable setups.

In an Uptrend

Once the pair had created a new short-term bottom, the price action rotates higher as it attempts to recover. At this point, we want to see where the retracement lines are located because of the following two reasons. Once you click it and the tool is selected, you need to identify an important price point on the chart where the uptrend or downtrend started, and a point when it ended.

It is also important in the financial markets; many traders use Fibonacci ratios to calculate support and resistance levels in their forex trading strategies. In this course, we are going to cover everything you need to know about Fibonacci retracement levels. Add a 50- or 200-bar moving average and odds increase further, encouraging bigger positions and a more aggressive trading strategy. This methodology applies to exits as well, telling forex traders to take profits when price reaches a retracement level that shows multiple alignments. Fibonacci levels are mainly used to identify support and resistance levels. When a security is trending up or down, it usually pulls back slightly before continuing the trend.

Applications and Use Cases of the Fibonacci Tool

Correction levels are mainly used in scalping and swing trading strategies and occasionally have the role of support or resistance levels. They are more suitable for intraday strategies with relatively little profit. Extension levels are used in long term strategies. They serve to predict a long-term trend in relation to the current trend highs and do not take into account local corrections.

For some reason, these fibonacci pattern forexs seem to play an important role in the financial markets, just as they do in nature. The fans are a charting technique consisting of diagonal lines that use these ratios to help identify key levels of support and resistance. They can be used to determine critical points that cause a price to reverse. The bottom line, if you add the Fibonacci tool to your trading strategy, trading will be much easier for you. Simply put, all you need to do is to learn how to draw support and resistance horizontal lines and apply Fibonacci retracement levels on your charts. Fibonacci analysis can improve forex performance for both short and long-term positions, identifying key price levels that show hidden support and resistance.

Great Trading Strategy

The chart shows three high price spikes with small rollbacks. According to Elliott’s theory, these are three wave price movements. Fibonacci levels plotted on the first high showed the potential support level, from which the correction pushed off twice. This example shows that Fibonacci retracement levels are used by traders as order consolidation zones, which when placed simultaneously can reverse the price in the desired direction. Stretch the Fibonacci ratios grid and wait for the price to hit 38.2%.

As with many aspects of trading, it’s always best practice to be cognisant of the higher timeframe trend and trade in harmony with it. Related to the last point, use the same timeframe on which you set the Fibonacci retracement to determine whether the area is likely to reverse. If you set it on the 1-hour chart, then look at how it closes on the same timeframe.

This will allow you to make perfectly straight parallel lines on the support and resistance points on the uptrend or downtrend. Check out the “What Goes on at Support and Resistance” areas if you have no prior knowledge as to what this is. As I said, the market tends to follow these lines, but sometimes it will fake traders out and they will end up losing a lot of money when it breaks the trend. In both scenarios, it is useful to wait for a candlestick pattern to confirm that the price is bouncing at the resistance spot or pushing through the support level. This helpful tactic has a high rate of ensuring a decent entry at the right time. Fibonacci time ratios explain how long a swing high swing low might take in time before the next swing high swing low starts.

Gold Struggles Below 2000, Euro Shrugs German Ifo – Action Forex

Gold Struggles Below 2000, Euro Shrugs German Ifo.

Posted: Mon, 27 Mar 2023 07:00:00 GMT [source]

Elliott found that there’s a strong connection between the legs of a contracting triangle and different Fibonacci levels. The un-extended waves in an impulsive move related to the golden ratio. The b-wave in a flat pattern MUST end beyond 61.8% Fibonacci retracement when compared with the previous a-wave. The Elliott Waves Theory cannot exist if it weren’t for the Fibonacci sequence. So important these levels are, that all the theory’s rules use them.

A bit of history of Fibonacci

Gartley in his book, “Profits in the Stock Market”. The pattern helps Forex traders in identifying higher probabilities of selling opportunities. The ABCD patternOne of the most classic chart patterns, the Forex ABCD pattern represents the perfect harmony between price and time.

- The low of the fib [0.0] can be seen acting as resistance as it propels price move to the first profit target at -0.618% expansion level.

- The second move in the opposite direction is called the “retracement”.

- Fibonacci ratios do not have biases for certain market conditions or economic cycles.

- Let’s take a look at two other examples of extensions hitting different Fibonacci levels.

- When a price is still gathering or losing momentum, it is more common to spot retracements of a higher percentage.

- The part in price action where it falls a bit before going back is called the retracement.

Fibonacci retracement levels are the favorite technical analysis tool of swing and scalping traders. They are based on a harmonic mathematical sequence with the golden ratio. The Fibonacci retracement tool can track potential price reversal points during a correction and confirm a trend reversal. In this review, you will learn how the Fibonacci retracement levels are built and how to use the Fibonacci tool to make money on financial markets. Forex Fibonacci retracement levels are depicted by using the high and low points on a chart and marking the key Fibonacci ratios of 23.6%, 38.2%, 61.8% horizontally in a grid. These horizontal lines represent potential reversal levels.

The Fibonacci number sequence and golden ratio is used by many savvy traders today so let’s look at how they can make huge profits in ANY financial markets. It can be seen how price movements have reacted to the Fibonacci retracement levels as support and resistance within the established price range. The Golden Ratio and these other derived Fibonacci numbers are ‘special’ numbers that form the Fibonacci retracement and extension levels.

It is important to note that any type of trading comes with high risk. Thus, to avoid losing your initial investment constantly educate yourself, seek independent financial advice, and remember the risks involved. The first and second points are placed at the beginning and end of the first wave of an uptrend. The third point is placed at the end of the correction, the chart is stretched to the right. Wait for the beginning of the trend – the reversal of the dying old movement, which should be confirmed by the oscillator or patterns.

Gold Short-Term Price Outlook: XAU/USD Breakout Pending – Action Forex

Gold Short-Term Price Outlook: XAU/USD Breakout Pending.

Posted: Thu, 30 Mar 2023 07:00:00 GMT [source]

An example of the Fibonacci tool being used in a downtrend is below. Notice price is stopped at the 38.2% Fibonacci level before again moving lower. An example of the three common levels and how to use them are below. In these examples all 3 diagrams are in an uptrend.

The picture above depicts a move from Point A to Point B. Now, as price begins to retrace back against Point A, it will most likely move to a Fibonacci Ratio. The most common retracements are the 38%, 50%, 62%, and 79%. By using the Fibonacci tool, traders usually try to identify support and resistance levels in currency markets. These levels represent areas wherein there is a high chance of a price reversal and they are extremely important price levels when they trade around the same level of Fibonacci retracements. When you combine Fibonacci levels and support and resistance levels, you essentially create target prices on your trading chart so it’s easier for you to find trading opportunities.

The trend stalls and retraces back 50% of the way. With confluence, I mean finding multiple reasons for taking a trade. Use the Awesome Oscillator – check when the zero line has been crossed and wait for a retrace back to that zero line. You now have confirmation that the move is 1 leg or swing high swing low.

The video shows a price interaction with the 61.8% Fibonacci level, which leads to a bounce from the area and to a new impulse in the direction of the previous trend. This created a nice trading opportunity on the chart, which our analyst took advantage of. Hence, it doesn’t always mean that the price will stop and reverse at some of the Fibonacci levels. This is especially the case if the market is in a strong trend, where you may see the price shooting through multiple Fibonacci levels in a single swing.